We’ve got a very exciting announcement to make…you can now pay your KidStart Savings into your Osper account to pay your little one’s pocket money.

If you’ve never heard of Osper, it’s an amazing mobile app and pre-paid card that helps teach your children how to spend and save their pocket money wisely with their own pre-paid card.

Both them and you will have an app to keep an eye on spending and give you the ability to set allowances, lock the card and load money for emergencies (or if they’ve earned it).

Over the past few months we’ve been working together on this partnership and we’re thrilled that we can finally share it with you.

From now on, the savings you collect in your Kiddybank can be transferred into your Osper account and you can then use this money to pay their pocket money.

How to add your Osper account in 3 easy steps:

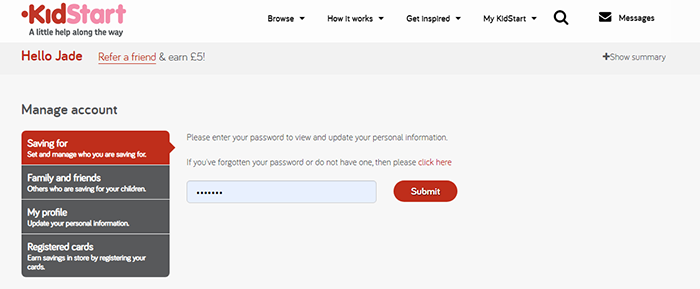

1. Head to the Manage Account page and the Saving For section.

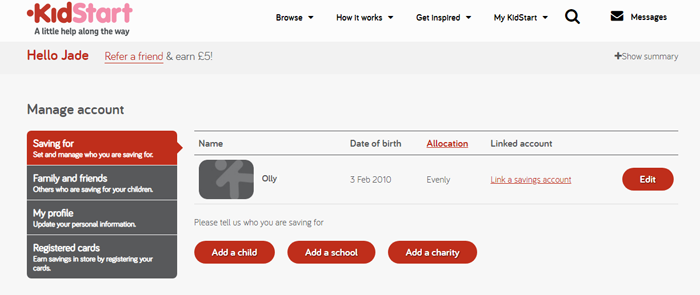

2. If you haven’t added your child you can do this now. If you have, click to ‘Link a savings account’

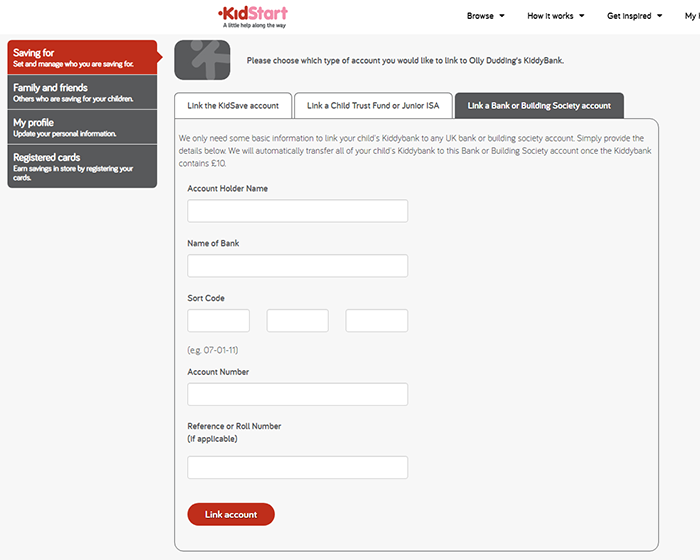

3. Choose to link a Bank or Building Society account and fill in the form as follows:

Account Holder Name – your name

Name of Bank – Osper

Sort Code – Osper doesn’t have sort codes so enter 00-00-00

Account Number – enter the 8 digit account number on the front of the card

Want to find out more about Osper?

We love Osper and think it’s a brilliant way to educate your kids about money. There are some great benefits including:

100% transparency: Parents have 100% transparency and real-time visibility of spending through the parent app.

No overdrafts: Young people can only spend the money that’s been loaded onto their Osper card.

Built-in spending limits: There are daily load and withdrawal limits on Osper cards and we monitor for unusual card activity.

Parent-approved ordering: The age at which parents decide to order an Osper Card for their children is completely up to them, they’re available from the ages of 8-18.

Restricted age-inappropriate transactions: Osper will not work in certain merchants by default, including bars, off-licences, casinos, online gambling and massage.

Online spending blocks: Choose upfront whether to block online spending then change on a per-child basis.

Simple card locking: If an Osper Card is lost or stolen, both young people and parents can lock their card directly in the app to block all purchases.

Text alerts: Osper provides text alerts when transactions are declined, adding an additional opportunity to monitor attempted spending and spot inappropriate purchases.

if you would like to find out more about Osper and how to order a card, head to the Osper website here.